maryland earned income tax credit stimulus

Some taxpayers may even qualify for a refundable Maryland EITC. Marylanders would qualify for these payments who annually earn.

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

It is equivalent to three children.

. Answer some questions to see if you qualify. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. 2 hours agoAs MarketWatch reported in 2020 theres a specific reason for this trend and it has to do with the complexities of the federal tax code.

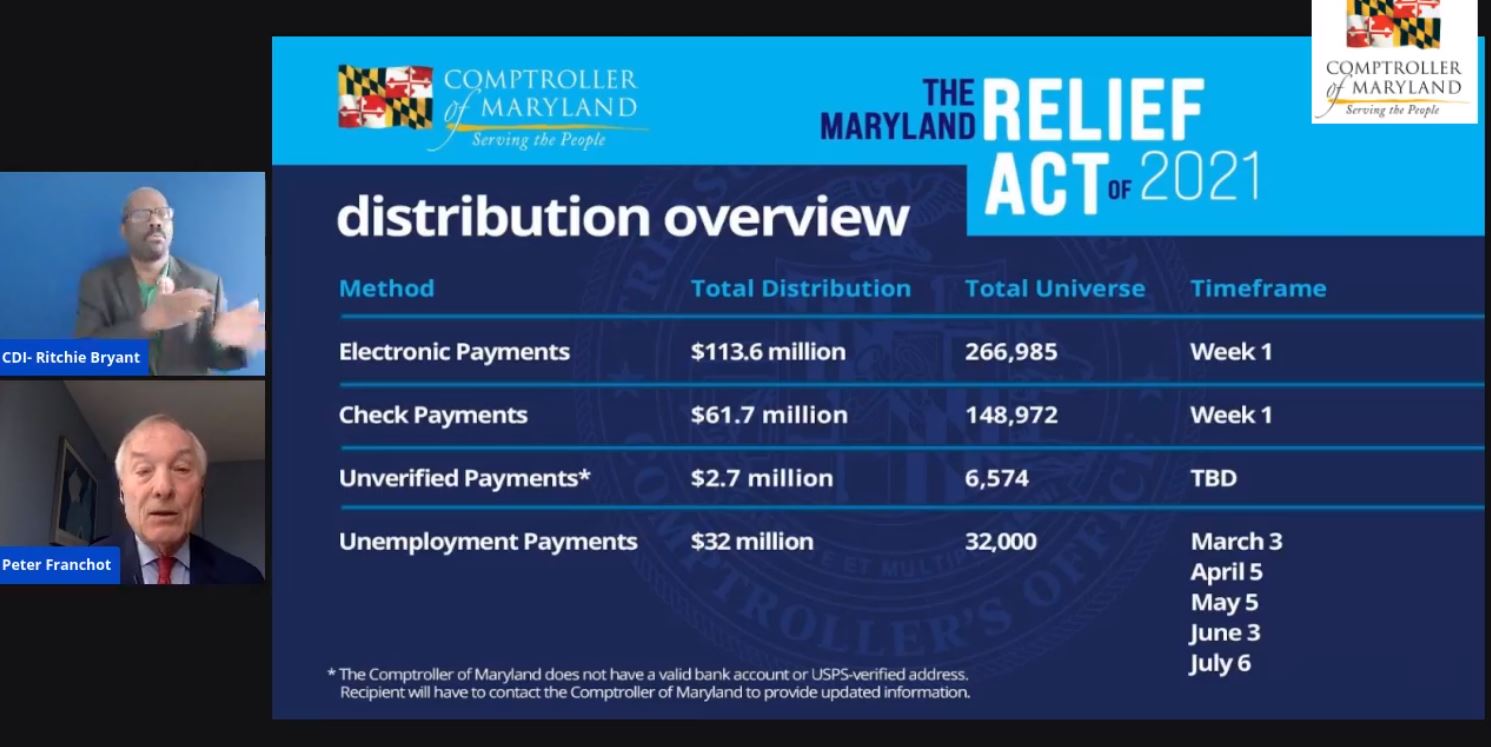

But since taxpayers need a Social Security number to qualify for the EITC thousands of immigrants wouldnt see any of that relief advocates said. Hogan Jrs R billion-dollar relief package relied on the Earned Income Tax Credit EITC to provide direct stimulus payments for low-income Marylanders hit hard by the pandemic. The Comptrollers Office will begin processing RELIEF Act payments to eligible recipients on February 16 2021.

The state EITC reduces the amount of Maryland tax you owe. You could argue those folks may be even. Required to file a tax return.

The EITC Assistant is a calculator that will help a taxpayer determine if they are eligible for the state. The Republican said Monday that the bill if passed would provide a total of 267 million in stimulus money to individuals and families who qualified for the Earned Income Tax Credit in 2019 and. In 2019 nearly 1.

1 General Info. -Single Filers earning. Maryland taxpayers who claimed and received the Earned Income Tax Credit had the following an-nual earnings.

The rebate caps at 750 for. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Eligible families can now apply for a one-time tax rebate to receive 250 for each child under age 18.

EIC Expansion and Child Tax Credit. On their 2019 Maryland state tax return. The Maryland Governors office say that the bill includes immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

Marylanders would qualify. Individuals who earned less than 200000 in 2021 will receive a 50 income tax rebate while couples filing jointly with incomes under 400000 will receive 100. If you do.

Similar to federal stimulus payments no application for relief is necessary. 47440 53330 married filing jointly with two qualifying children. The Maryland Governors office say that the bill includes immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit.

Tax Alert - Maryland RELIEF Act 4202021 - Superseded. 50954 56844 married filing jointly with three or more qualifying children. Marylands median income is among the highest in the country but the state also has a large low-income population.

If your permanent home is or was in Maryland OR your permanent home is outside of Maryland but you maintained a place to live in Maryland and were physically present in the state. Postal Service your payment will be electronically transmitted. 2 days agoConnecticut offers a one-time rebate of 250 for every child under 18.

Marylanders would qualify. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. 2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

41756 47646 married filing. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Tax Alert 03-11-2021 Extension of Time to File and Waiver of Interest and Penalty for Certain Filers.

Thelocal EITC reduces the amount of county tax you owe. DIRECT STIMULUS PAYMENTS FOR LOW TO MODERATE-INCOME MARYLANDERS This relief begins with immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit. Franchot said his office has already started processing roughly 267000 electronic payments and 149000 paper checks for 422531 eligible stimulus recipients totaling more than 175 million will soon head out to low-income Marylanders who filed for the Earned Income Tax Credit EITC in 2019 and still live in the state.

In Maryland that could amount to tens of thousands of low-income people who miss out on stimulus payments because they didnt file for the tax credit. The Maryland Governors office say that the bill includes immediate payments of 500 for families and 300 for individuals who filed for the Earned Income Tax Credit EITC. If you have a validated bank account number on file from your Tax Year 2019 Maryland State Tax Return and a mailing address that has been verified by the US.

However 750 is the maximum amount a taxpayer will receive. One thing these poorer communities have in common is that many residents claim the earned income tax credit EITC an anti-poverty program for low- to moderate-income working individuals and couples particularly those with. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

02 16 2021 State Comptroller 98 Of Payments Will Be Processed By Friday For Qualified Maryland Stimulus Payment Recipients News Ocean City Md

Americans Will Receive A Tax Credit Worth Up To 1 750 Are You Eligible

Relief Act Of 2021 Tax Stimulus Relief Bethesda Cpa Firm

Comptroller Of Maryland Comptroller Of Maryland Tax Season News Conference Facebook By Comptroller Of Maryland Comptroller Franchot On Wednesday Morning Will Join Key Agency Personnel To Announce Major

How To Get 1 000 Stimulus Checks If You Live In These States

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Franchot Urges Md Lawmakers To Ok 2 000 Survival Checks Wbff

Maryland State Stimulus Checks Turbotax Tax Tips Videos

Fifth Stimulus Checks Tax Return Irs

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

Maryland Relief Act For Individuals And Businesses Glass Jacobson Wealth Advisors

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

Maryland Relief Act Of 2021 What Taxpayers Need To Know Now Sc H Group

Maryland Comptroller Checks Residents Received Should Be 2 000 Wusa9 Com

Hogan Signs Billion Dollar Relief Act Into Law Maryland Matters

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

Income Tax Season 2022 What To Know Before Filing In Maryland Annapolis Md Patch

Child Tax Credit In 2022 See If You Ll Be Paid 750 From Your State Cnet